Published:

Last modified:

The late night levy - an operator's guide

What is the Late Night Levy?

A Licensing Authority can introduce a Late Night Levy (“the Levy”) if it considers it is ‘desirable’ to raise revenue in relation to the costs of policing crime and disorder related to the sale and supply of alcohol or late night refreshment in an area(s) for which it is responsible between midnight and 06:00.

Who does it apply to?

The Council can specify the time (between midnight and 06:00) after which if any Premises Licence Holder or holder of a Club Premises Certificate, is authorised to sell or supply alcohol or provide late night refreshment (serving hot food) they are liable to pay the Levy whether or not they choose to do so (relevant late night alcohol authorisations and relevant late night refreshment authorisations).

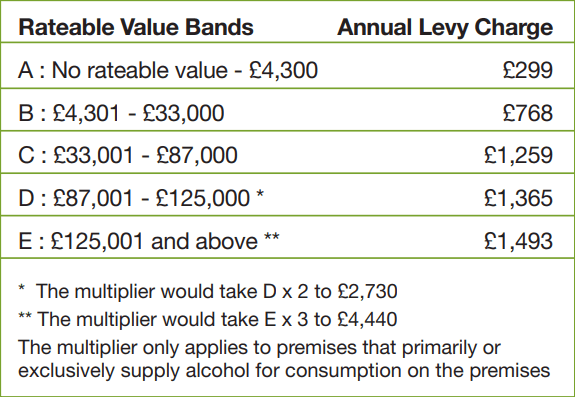

How much will it cost if my business is subject to the Late Night Levy?

There is no reduction based on either the number of days you are permitted to trade beyond the specified late night authorisation times in a week, nor the number of hours you trade beyond the Specified Time, i.e., if you trade on one day a week beyond the specified late night authorisation times you are liable to pay the full Levy.

Please note therefore whilst the premises may not be open under the benefit of a Premises Licence or Club Premises Certificate, the Premises Licence Holder is still liable to pay the Late Night Levy.

Note: The Levy becomes payable 14 days after the date of the grant of any licence or variation beyond the specified late night authorisation times and in subsequent years the Levy is payable on that same day.

For Premise Licences or Club Premise Certificates permitting the sale or supply of alcohol or late night refreshment beyond the specified late night authorisation times when the Levy is introduced, the levy is then due on the same day as the Annual Fee.

There are no reductions if you voluntarily apply to reduce your hours below the specified late night authorisation times, or indeed if the hours are reduced below the specified late night authorisation times after the review of a premises licence.

If the Levy is not paid by the due date then similar to the payment of the annual fee, the Premises Licence can be suspended unless the amount of the payment or liability is disputed prior to it falling due or there has been an administrative error, when there is a 21 day grace period after which the Licensing Authority has to give the Premises Licence Holder at least two working days notice of the suspension.

What is the procedure for the introduction of the Late Night Levy?

Prior to the implementation of the Levy, the Licensing Authority must send a copy of its proposals to all holders of Premises Licences and Club Premises Certificates whose licences or certificates permit them to sell alcohol or provide late night refreshment beyond the specified late night authorisation times, together with the Police and put a notice of its proposal on its website and in the local newspaper. The notice must specify the start date for the Levy, the proposed Specified Time and any permitted exemption or reduction categories, and the proportion of the Levy that will be given to the Police (at least 70%).

Are there any exemptions?

Licensing Authorities have the discretion to allow certain types of premises to be exempt from the Levy. Examples of premises which are included as being a discretionary exemption are premises with overnight accommodation, theatres and cinemas and country village pubs (pubs which are within a designated rural settlement with a population of less than 3,000), and additionally, premises which operate as part of a Business Improvement District with a ‘satisfactory’ crime and disorder focus.

New Year’s Eve is included as a discretionary exemption.

What are the discounts?

Licensing Authorities will be able to offer a discretionary 30% reduction in the Levy to ‘Best Practice Schemes’ provided such schemes meet specified criteria and premises qualifying for the Small Business Rate Relief.

See the relevant legislation for full details.

The Licensing Authority can use part of the Levy (30% maximum after the costs of the administration and management of the Levy are deducted) for the management of the night-time economy, and for services that prevent and tackle alcohol related crime and disorder.

Printable PDF

Download a printable PDF of this guide using the link below